Hassle Free Solutions

Talk to us now ~ Voice and WhatsApp +94771325070

For a free consultation

News and Events

Registration of Resident Persons in Sri Lanka

With effect from January 01, 2024, any individual who is at the age 18 years or more, or who attains the age of 18 years on or after January 01, 2024, it is mandatory to register with the Inland Revenue Department and obtain a TIN (Taxpayer Identification Number). Furthermore, any person who receives an income over Rs. 1,200,000/- for a year of assessment (from April 01 of a year to March 31 of the following year), shall register for the Income Tax. Persons who do not obtain registration, as per above instructions, will be registered by the Inland Revenue Department and shall be subjected to a penalty not exceeding Rs. 50,000/-. The extraordinary gazette that carries the notification on the above registration can be downloaded through the following link.

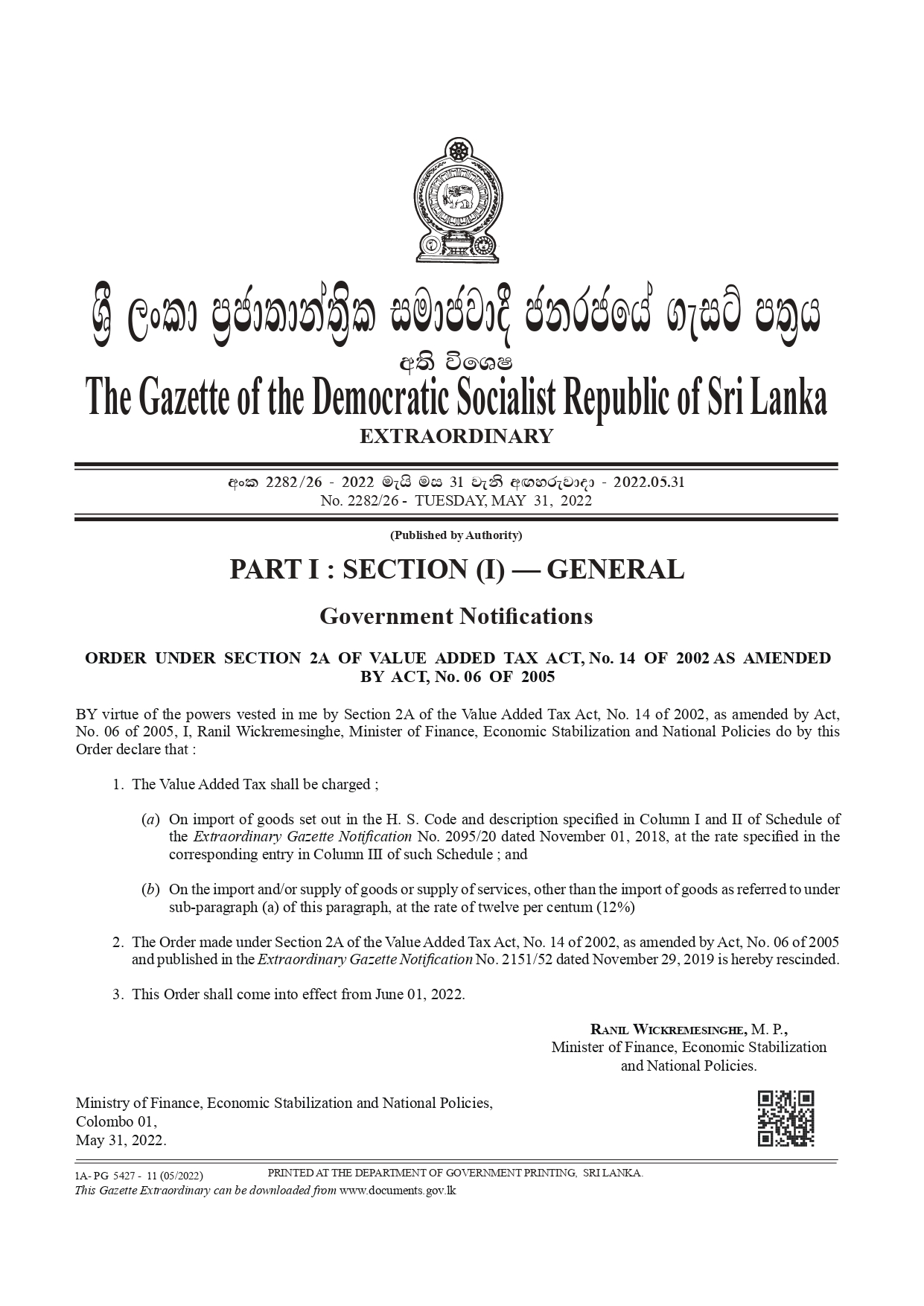

Extraordinary Gazette Notification Order under Section 2A of Value Added Tax Act, No. 14 of 2002 as amended by Act, No. 06 of 2005

By virtue of the powers vested in me by Section 2A of the Value Added Tax Act, No. 14 of 2002, as amended by Act, No. 06 of 2005, I, Ranil Wickremesinghe, Minister of Finance, Economic Stabilization and National Policies do by this Order declare that : 1. The Value Added Tax shall be charged ; (a) On import of goods set out in the H. S. Code and description specified in Column I and II of Schedule of the Extraordinary Gazette Notification No. 2095/20 dated November 01, 2018, at the rate specified in the corresponding entry in Column III of such Schedule ; and (b) On the import and/or supply of goods or supply of services, other than the import of goods as referred to under sub-paragraph (a) of this paragraph, at the rate of twelve per centum (12%) 2. The Order made under Section 2A of the Value Added Tax Act, No. 14 of 2002, as amended by Act, No. 06 of 2005 and published in the Extraordinary Gazette Notification No. 2151/52 dated November 29, 2019 is hereby rescinded. 3. This Order shall come into effect from June 01, 2022.

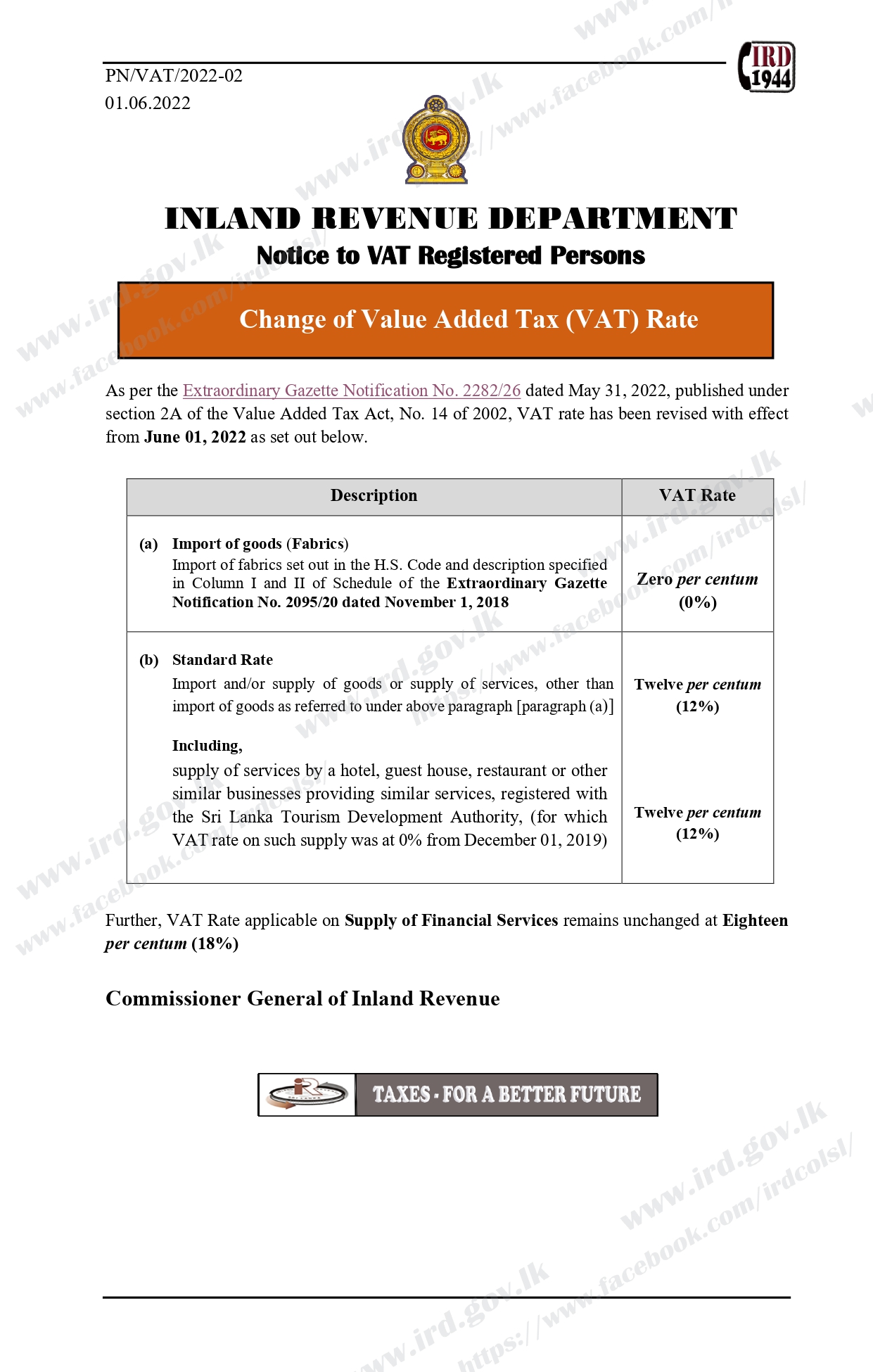

Change of Value Added Tax (VAT) Rate

As per the Extraordinary Gazette Notification No. 2282/26 dated May 31, 2022, published under section 2A of the Value Added Tax Act, No. 14 of 2002, VAT rate has been revised with effect from June 01, 2022 as set out below.

Online Tax Payment Platform (OTPP)

It is informed that the Online Tax Payment Platform (OTPP) is in functions to make tax payments with the collaboration of below mentioned banks in addition to the usual methods of tax payments. In the case of curfew or civil unrest where you cannot reach the Banks to make cash/cheque payments, you are kindly requested and compelled to make the payments using the corporate/personal banking facilities through OTPP system. Facilitating Banks for OTPP system

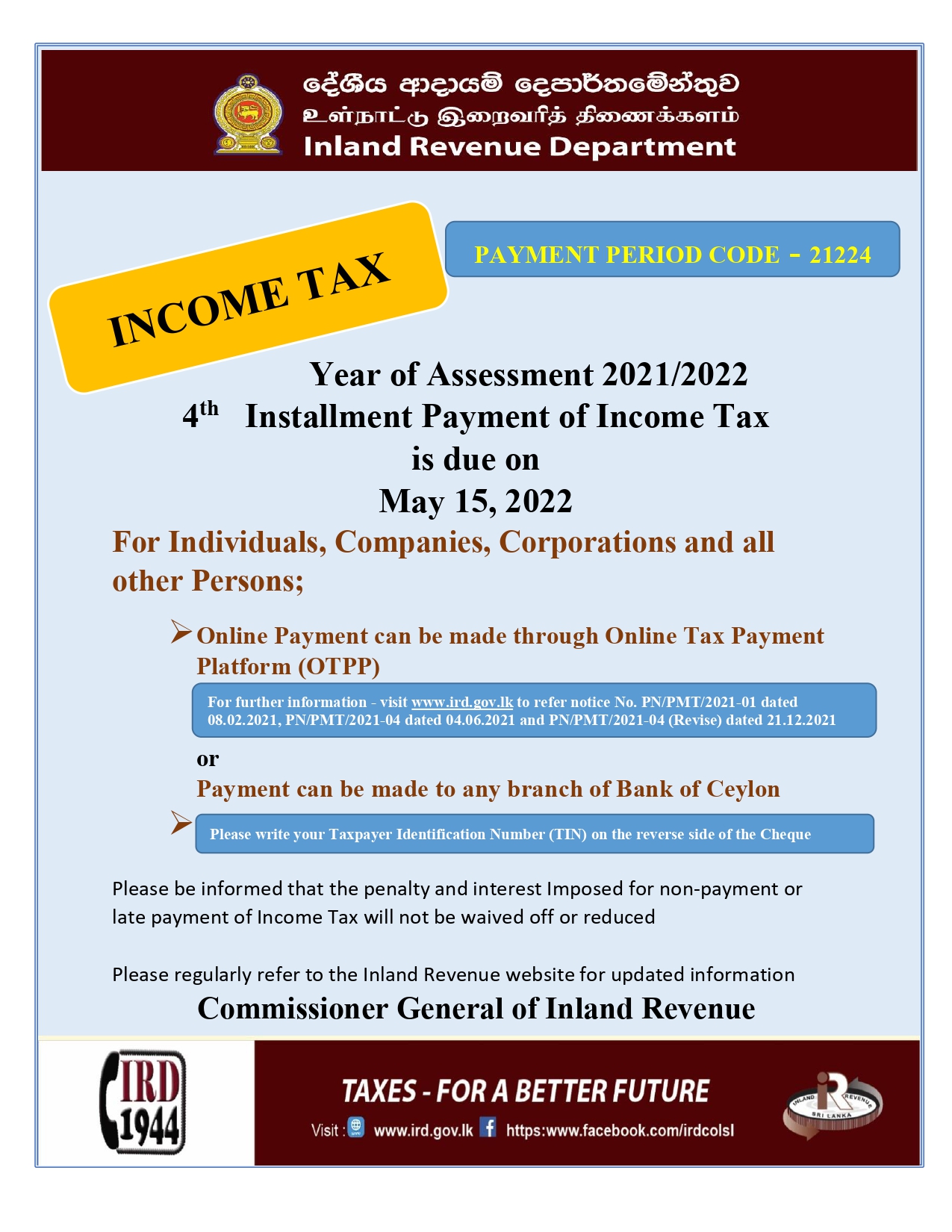

4th Installment Payment of Income Tax

For Individuals, Companies, Corporations and all other Persons; Online Payment can be made through Online Tax Payment Platform (OTPP) or Payment can be made to any branch of Bank of Ceylon Please be informed that the penalty and interest Imposed for non-payment or late payment of Income Tax will not be waived off or reduced

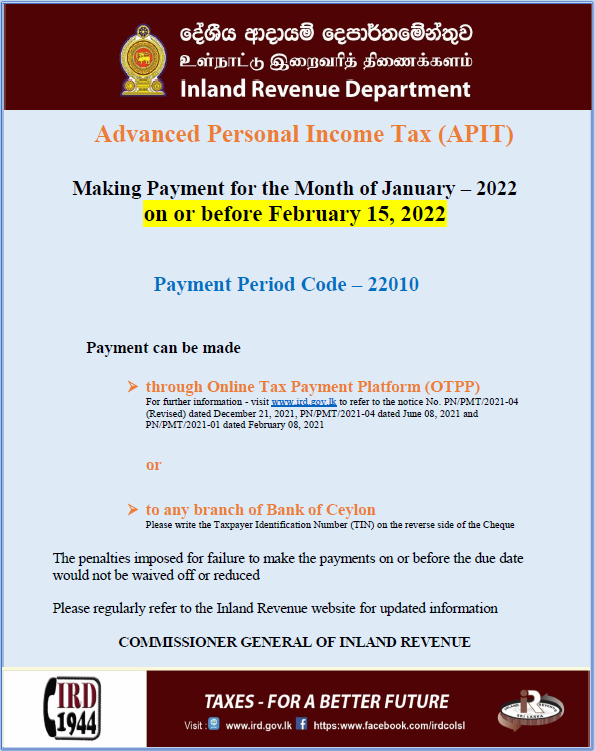

Making Payment for the Month of January – 2022 on or before February 15, 2022

The penalties imposed for failure to make the payments on or before the due date would not be waived off or reduced Please regularly refer to the Inland Revenue website for updated information